17+ Kansas Paycheck Calculator

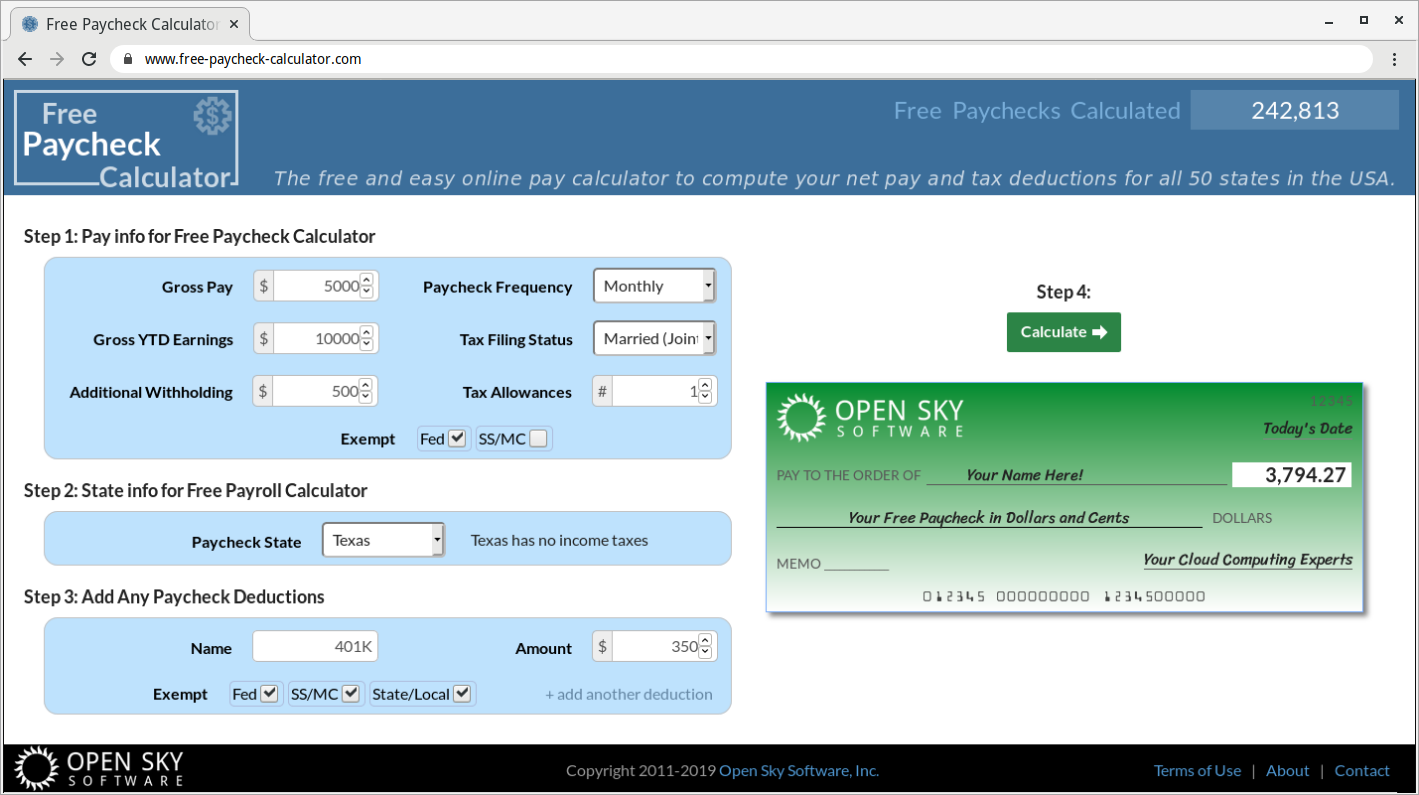

Well do the math for youall you. Use this Kansas gross pay calculator to gross up wages based on net pay.

Sales Tax Calculator

For example if an.

. Web Kansas Paycheck Calculator. Simply enter their federal and state W-4. Payroll Seamlessly Integrates With QuickBooks Online.

Web The state income tax rate in Kansas is progressive and ranges from 31 to 57 while federal income tax rates range from 10 to 37 depending on your income. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kansas. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Web Use Kansas Paycheck Calculator to estimate net or take home pay for salaried employees. Web Find out how much youll pay in Kansas state income taxes given your annual income. Payroll check calculator is updated for payroll year 2023 and new W4.

Simply input salary details benefits and deductions and any other. Web 2023 Kansas Gross-Up Paycheck Calculator. Customize using your filing status deductions exemptions and more.

Are you a resident of Kansas and want to know how much take-home pay you can expect on each of your paychecks. Important Note on Calculator. Web The Kansas Department of Revenue offers a free online Kansas paycheck calculator that will help you determine the exact amount of your take-home pay after.

Web Kansas Salary Paycheck Calculator Calculate your Kansas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local. Web The Kansas Salary Calculator updated for 2024 allows you to quickly calculate your take home pay after tax commitments including Kansas State Tax Federal State Tax. It will calculate net paycheck amount that an employee will receive based.

For example if an employee receives 500 in take. The results are broken up into three sections. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kansas.

Use our simple paycheck calculator to estimate your net or take. Web Kansas Federal Hourly Paycheck Calculator Results Below are your Kansas salary paycheck results. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Web Tax Year 2023. Last Updated on September 28 2023 By entering your period or yearly income together with the relevant federal state and local W4. Web Kansas Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Use our paycheck tax. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Just enter the wages tax. Web If youre wondering How do I figure out how much money I take home in Kansas weve got you covered. Payroll Seamlessly Integrates With QuickBooks Online.

Paycheck Calculator is a. Use ADPs Kansas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web How to calculate annual income.

Web How to Calculate Your Paycheck in Kansas. Web Kansas Paycheck Calculator Calculate your take-home pay after federal Kansas taxes Updated for 2023 tax year on Sep 19 2023 What was updated. Web Kansas Hourly Paycheck Calculator.

Web Kansas Paycheck Calculator. Web Hourly Paycheck Calculator. Tax year Job type.

Web There are only three tax rates for long-term capital gains ranging from 0 to 20 and the IRS notes that most taxpayers pay no more than 15. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide.

Web Kansas Paycheck and Payroll Calculator Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount. Enter your info to see your take home pay.

Driving School Munich English Driving School Free Theory App Book

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

Anon Turns 18 R Greentext

Paycheck Calculator Take Home Pay Calculator

Kansas Department Of Labor Working To Get Additional Benefits To The Unemployed

Early College Opportunities For High School Students Barton Community College

About Free Paycheck Calculator

5 Best Tax Relief Companies Of 2023 Money

The Performance Digest June 2022 Issue 68 By Science For Sport Issuu

Driving School Munich English Driving School Free Theory App Book

Everything About H1b Prevailing Wages Various Levels 2023

Corporate Tax In The United States Wikipedia

![]()

Jeff Wilson Jr Fantasy Football Waiver Wire Pickups Week 10 2022 Fantasy News

Kansas Sales Tax Calculator Reverse Sales 2023 Dremployee

Lter Network Bibliography Lter2016 Bib At Master Lter Lter Network Bibliography Github

Cells Free Full Text Host Vesicle Fusion Protein Vapb Contributes To The Nuclear Egress Stage Of Herpes Simplex Virus Type 1 Hsv 1 Replication

12 Nfl Prop Bets To Target In Week 7 Including Ezekiel Elliott Travis Etienne Jr And Wan Dale Robinson